Contract Hire

Contract Hire

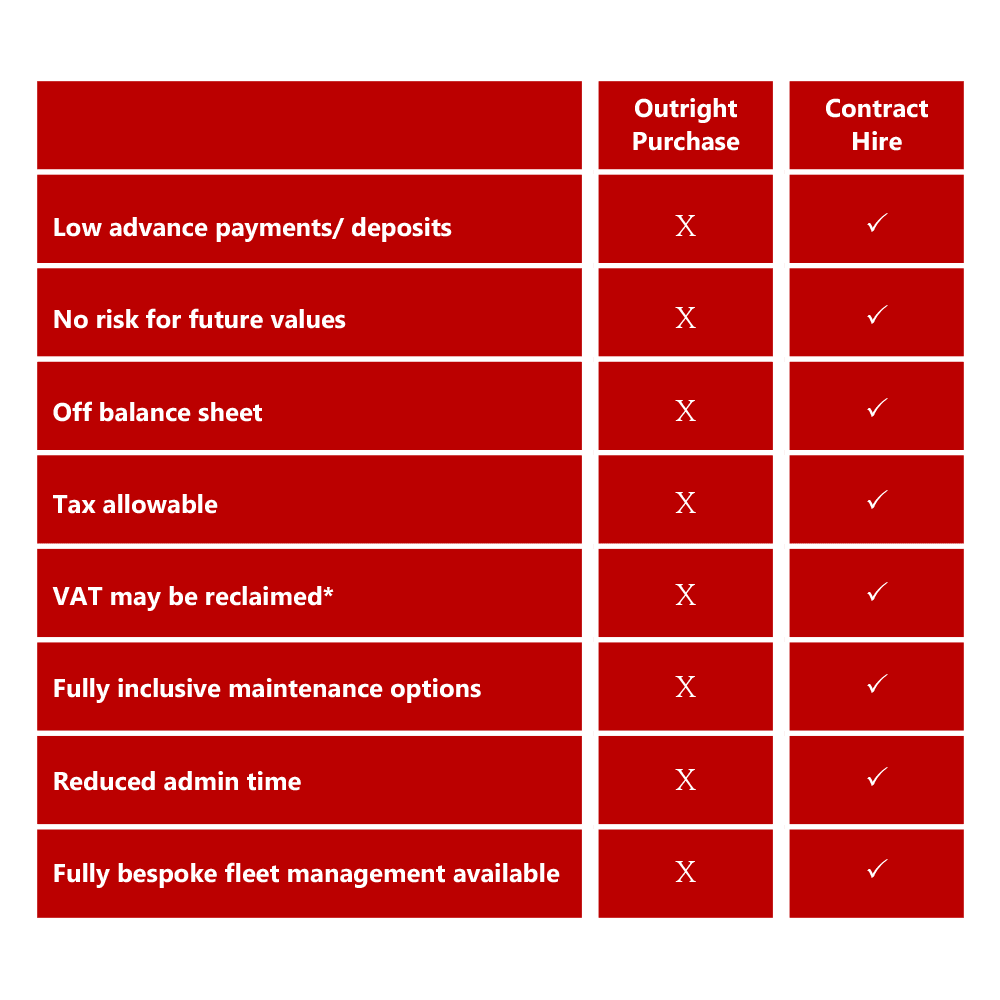

Advantages of leasing vehicles

Less initial expenseThe primary advantage of leasing vehicles is that it allows you to acquire assets with minimal initial expenditures. Because vehicle leases rarely require a large down payment, you can obtain the vehicles you need without significantly affecting your cash flow.

Tax deductible

Lease payments can usually be deducted as business expenses on your tax return, reducing the net cost of your lease.

Flexible termsLeases are usually easier to obtain and have more flexible terms than loans for buying vehicles. This can be a significant advantage if you have bad credit or need to negotiate a longer payment plan to lower your costs.

Latest models

As leases are for a fixed term it allows your vehicle fleet to be easily updated every 2 or 3 years, there is also no end of term disposal issues associated with outright purchase of vehicles

* Restrictions on reclaiming VAT may apply

Interested in our services? We’re here to help!

We want to know your needs exactly so that we can provide the perfect solution. Let us know what you want and we’ll do our best to help.